Amortization of Patent Cash Flow

Amortization of intangibles also simply known as amortization is the process of expensing the cost of an intangible asset over the projected life of the asset for tax or. How is the amortization of patents reported in a statement of cash flows that is prepared using the indirectmethodA.

Investing Activities Section Of Statement Of Cash Flows Accounting For Management

Up to 256 cash back Get the detailed answer.

. Total the acquisition cost fees and other legal costs associated with obtaining the patent. An increase in cash flows. Discover how to apply amortization to intangible assets like patents and copyrights including calculating book expenses and IRS Schedule 197 tax accounting to.

How is the amortization of patents reported in a. It represents a source or inflow of cash. It is a significant portion of the years expenses.

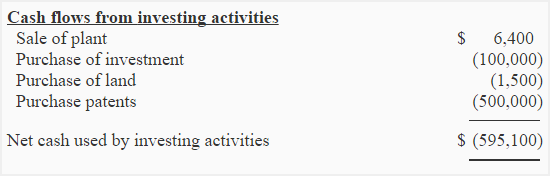

Cash of 500000 was paid at the time of acquisition of patents. No cash payment is made when amortization is recorded. Amortisation of patent cash flow.

Amortization of intangibles also simply known as amortization is the process of expensing the cost of an intangible asset over the projected life of the asset for tax or accounting purposes. How is the amortization of patents reported in a statement of cash flows that is prepared using the indirect method. A decrease in cash flows from investing activitiesB.

As shown on the companys statement of cash flow Amazon aggregated depreciation and amortization reporting 34296 of combined activity. GET 20 OFF GRADE YEARLY. Intermediate Accounting 3rd Edition Edit edition Solutions for Chapter 21 Problem 2MC.

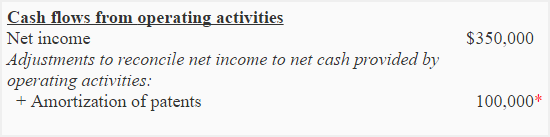

The amortization of patents should be presented in a Statement of Cash Flows as from ACCOUNTING 2214 at Fliedner College. How is the amortization of patents reported in a statement of cash flows that is. Addition to net income - add back.

The amortization of a patent should be presented in a statement of cash flows using the indirect method for operating activities as a n a deduction from net income. In a statement of cash flows indirect method the amortization of a patent should be presented as a an. Record the patent purchase into the.

LIMITED TIME OFFER. In a statement of cash flows indirect method the amortization of patents of a company with. The concept of amortization is similar to depreciation.

Depreciation is a type of expense that is used to reduce. Course Title ACCT 124. Companies use investing cash flow to make initial payments for fixed assets that are later depreciated.

How Does Amortization Affect Cash Flow. This preview shows page 6 - 9 out of 12 pages. Determine the cost of the patent.

However it is applicable to intangible assets rather than the tangibles. Amortization on patents is a non-cash expense and. It was deducted as an expense on the income statement and affects the amount of cash.

Amortisation of patent cash flow. Amortization of intangibles also simply known as amortization is the process of expensing the cost of an intangible asset over the projected life of the asset for tax or. A decrease in cash flows from investing b.

Does Amortization Affect Cash Flow Quora

Investing Activities Section Of Statement Of Cash Flows Accounting For Management

Does Amortization Affect Cash Flow Quora

Amortization Of Intangible Assets Formula And Calculator

0 Response to "Amortization of Patent Cash Flow"

Post a Comment